2023’s Crypto and Travel Rule Predictions: What 21 Got Right

In 2022, the cryptocurrency industry experienced a notable shift toward regulatory clarity, which guided our predictions for 2023. After consulting our tea leaves, we predicted greater Travel Rule adoption outside the EU, more self-hosted wallet use cases, a growing focus on stablecoins and CBDCs, and more bitcoin use as local currency.

Below, we summarise our 2023 predictions along with what we got right.

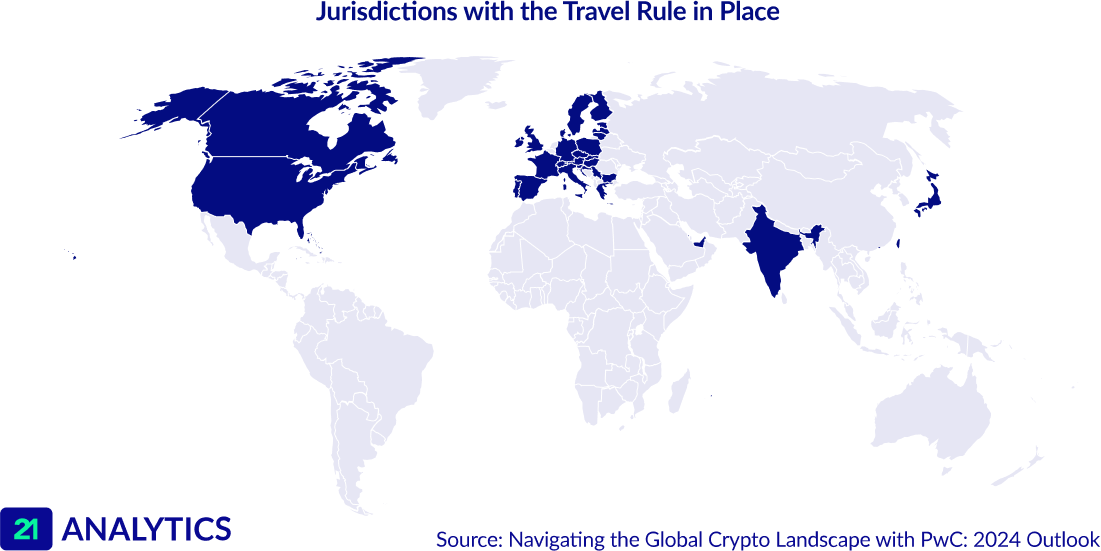

21’s Prediction: Greater Travel Rule Adoption Outside of the EU

The EU's Transfer of Funds Regulation (TFR) and Markets in Crypto Asset Regulation (MiCA) spurred global adoption of the Travel Rule. This trend is set to hasten the resolution of the sunrise issue for virtual asset service providers (VASPs), ensuring quicker regulatory compliance and offering customers more regulated trading conditions in 2023.

What 21 Got Right

In 2023, the UK, Dubai, and Hong Kong implemented their variations of the Travel Rule, with regions like Spain and Turkey pushing for adoption by early 2024. Additionally, the Financial Action Task Force’s (FATF) Virtual Assets Contact Group (VACG) hosted a meeting in Japan earlier this year pushing for global adoption, encouraging jurisdictions that have already implemented the Travel Rule to provide advice to those still in the process thereof.

21’s Prediction: A Shift Towards Self-Hosted Wallets

In 2022, issues with big exchanges eroded customer trust, prompting a search for alternatives to safeguard valuable crypto assets. 2023 may see a rise in self-hosted wallet adoption, supported by VASPs offering compliance software with diverse ownership verification methods, easing the transition for users.

What 21 Got Right

With cryptocurrencies becoming less niche and more mainstream, especially with the increase in global regulations, users have moved away from investing and sought methods to hold their coins, which are now used as payment methods.

Currently, Europe is the largest market, with the Asia Pacific being the fastest-growing market due to the shift towards a cashless and digital economy in regions like Japan and South Korea.

21’s Prediction: Growing Focus on Stablecoins

Investors sought stability in volatile markets through stablecoins, which in turn may prompt regulators to relook at existing regulations. MiCA, for example, has scrutinised stablecoin (EMT and ART) governance and passed regulations for investor protection in the European market.

Read: Stablecoins Are No More: MiCA’s EMTs and ARTs Explained

What 21 Got Right

The European Banking Authority (EBA) released 4 consultations related to stablecoins under MiCA on 8 November.

The UK has cast its sights on stablecoins and has entered a consulting phase regarding the topic. As it stands, the existing Electronic Money Regulations 2011 and Payment Service Regulations 2017 will be amended to include stablecoin issuance and the provision of wallets and custody services. Moreover, Part 5 of the Banking Act 2009 will be extended to include stablecoin activities, and the scope of the Financial Services (Banking Reform) Act 2013 will be updated to ensure relevant stablecoin-based payment systems are subject to appropriate competition regulation by the Payment Systems Regulator (PSR)*

The FATF VACG also highlighted the need to regulate stablecoins to comply with AML/CFT regulations and is investigating the topic.

The Financial Security Board (FSB) also has stablecoins in their sites according to their article High-level Recommendations for the Regulation, Supervision and Oversight of Global Stablecoin Arrangements: Final report. According to the FSB’s 10 Recommendations, authorities should:

Have the necessary powers, tools, and resources to regulate, supervise, and enforce laws on global stablecoin arrangements (GSC) arrangements effectively,

Apply comprehensive regulatory and oversight requirements to GSC arrangements based on their functions, proportionate to risks, and consistent with international standards.

Foster efficient communication and information sharing among authorities domestically and internationally to ensure comprehensive regulation and oversight of GSC arrangements.

Require GSC arrangements to have clear governance structures, lines of responsibility, and accountability for all functions and activities.

Implement effective risk management frameworks addressing operational resilience, cybersecurity, AML/CFT measures, and comply with "fit and proper" requirements.

Implement robust frameworks for collecting, storing, and reporting data. Authorities should have access to necessary data for regulatory purposes.

Have appropriate plans for recovery and resolution.

Mandate GSC issuers and participants to provide transparent information about the arrangement, including governance, conflicts of interest, redemption rights, stabilisation mechanism, operations, risk management, and financial condition.

Require GSC arrangements to provide users with a legal claim, ensure timely redemption, and implement stabilisation mechanisms and prudential requirements to maintain stable value.

Comply with all jurisdiction regulatory requirements before commencing operations and adapt to new requirements as necessary.

*accurate at the time of print.

Read FATF Virtual Assets Contact Group (VACG): 21’s Takeaways

21’s Prediction: Bitcoin Adoption As Local Currency

Rising inflation and currency instability in developing nations have fueled a growing interest in adopting bitcoin as a local currency for stability. The Central African Republic and El Salvador were pioneers in successfully implementing Bitcoin as legal tender. While they are currently the only countries to have done so, it is anticipated that more nations will follow suit in 2023.

What 21 Got Right

While 2023 did not see an increase in bitcoin adoption as local currency, there are rumours that the recently elected pro-bitcoin Argentine President may push for this as he attempts to move away from Argentina’s central bank. Javier Milei sees bitcoin as a way to revive the economy and beat the 140% inflation the Argentine peso saw over the last year.

21’s Prediction: An Increase in Central Bank Digital Currencies

The Bahamas led the way in implementing the Sand Dollar in 2020. In 2022, several governments either implemented Central Bank Digital Currencies (CBDCs) or called for proposals for their development. This trend is expected to continue into 2023 and the future, as many governments see CBDCs as a means to establish a presence in the crypto ecosystem, bring digital currency to the public, and maintain control over digital currency sovereignty.

What 21 Got Right

In 2023, we saw plenty of movement towards CBDCs. The following countries conducted their first explanatory CBDC research in 2023.

Australia

Belarus

Columbia

Hong Kong

Israel

Malaysia

Mauritania

Mauritius

Montenegro

Singapore

South Korea

USA

Whereas, Switzerland is in its pilot phase, meaning it has developed a CBDC that was tested in a real environment, and Jamaica launched its CBDC, the JAM-DEX.

2023 was a thriving year for the crypto ecosystem, with the expansion of several relevant use cases and increased clarity within regulations.

Don’t let 2024 take you by surprise; read 2024’s Top 5 Crypto and Travel Rule Predictions.

Or reach out to us; we would be happy to assist you on your journey to compliance.