21 Travel Rule Integrates Chainalysis Data for Risk Assessment

Blockchain analysis allows cryptocurrency companies (also known as virtual asset service providers or VASPs) to better assess the risks associated with their virtual asset transactions.

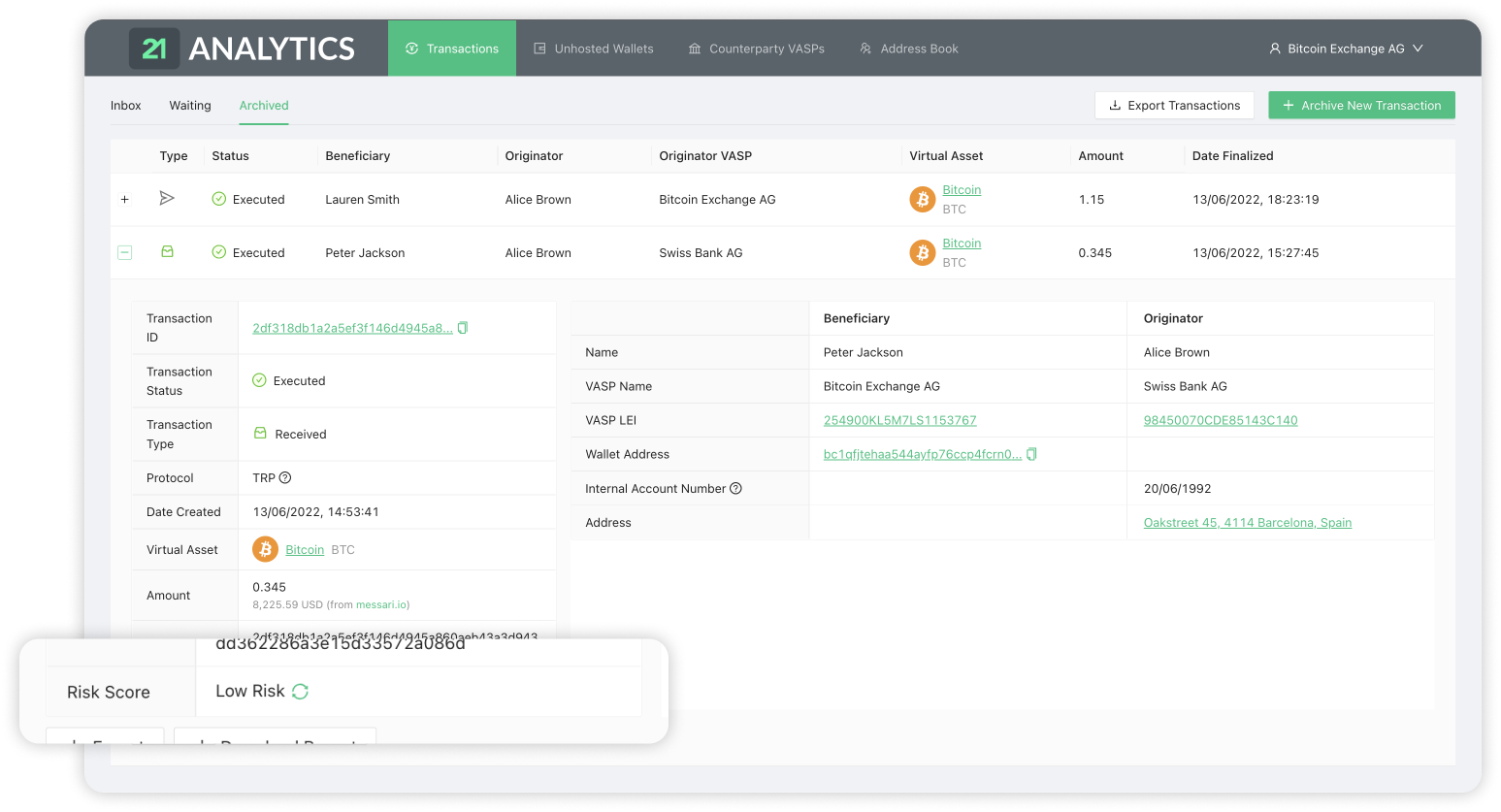

One of the industry’s leading blockchain data companies, Chainalysis provides automatic blockchain transaction monitoring to VASPs. The data provided helps identify illicit activity and deliver intelligence to their compliance teams. We have integrated Chainalysis into our Travel Rule product as an optional module, strengthening our objective of lightening the load for compliance officers. We are thrilled to be a part of their partner network. By mapping wallets, tracing transactions and scanning sanctions lists, Chainalysis identifies and categorises the risk associated with a given address. Using this intel, a VASP can easily (and even automatically) decide if it should proceed with a transfer involving that address based on its own compliance policies. Chainalysis automatically associates a risk score to a transfer, which you can directly see in your 21 Travel Rule interface after a blockchain transaction has been associated with a virtual asset transfer.

My Team Already Uses Chainalysis. How Can We Benefit From the 21 Travel Rule Integration?

Since you already have Chainalysis set up, your team probably has its own business rules defined on how to approach different levels of risks. On the Chainalysis platform, you can find your API key, which you can add to your settings in the 21 Travel Rule tool. Afterwards, Chainalysis’ risk scores will automatically be queried on your behalf and show up in the transactions dashboard, streamlining your compliance tasks. 21 Travel Rule allows you to comply with the Financial Action Task Force (FATF) Travel Rule, and the integration with Chainalysis helps VASPs perform risk-based approaches as required by the FATF. Check out our integration on a 21 Travel Rule demo!