21 Travel Rule: Version 6 Released

Refer to our Product Release Notes for the most recent 21 Travel Rule updates.

We are pleased to announce the latest update of 21 Travel Rule: Version 6. The previous release of Version 5 saw some remarkable improvements, and Version 6 has just trumped those.

As with our previous versions, virtual asset service providers (VASPs) can be guaranteed that when using the product, they are fully compliant with the Financial Action Task Force’s (FATF’s) Travel Rule. Moreover, because 21 Travel Rule is run on-premises VASPs can be assured easier GDPR compliance as nobody can access delicate customer data apart from them.

Version 6 offers VASPs absolute power at their fingertips. Now the compliance team can better identify customers’ names received from their counterparty through fuzzy name matching, have tables automatically switched from .csv to .xlsx format when downloaded, and reap the rewards from complete TRP 3.0 support, amongst other updates.

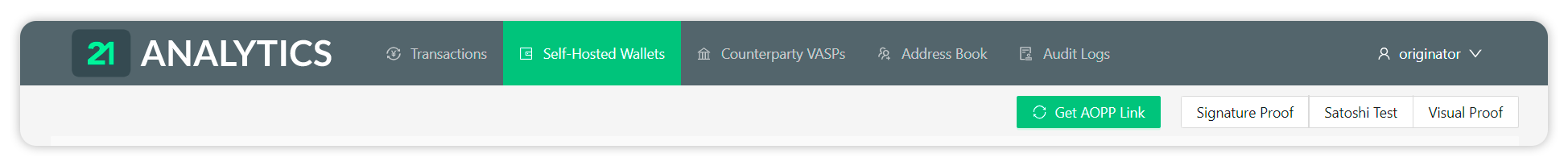

However, the feather in our cap is that VASPs now have 4 options for verifying ownership of self-hosted wallet (unhosted wallet); only 21 Travel Rule offers coverage of all available methods. VASPs can choose from one of the wallet verification ways seen in the previous versions, such as Address Ownership Proof Protocol (AOPP) and Manual Signing, as well as the recently added Satoshi Test and Visual Proof option, which includes video and screenshot uploads as wallet verification proofs.

Why the Focus on Self-hosted Wallet Verification Methods?

Many countries have adopted FATF’s Recommendation 16; for example, the European Union released its guidance parallel to the FATF’s - the Transfer of Funds Regulation (TFR). These guidelines specified that wallet verification is a key demand when transfers involve a self-hosted wallet and a VASP. With this in mind, VASPs may offer a variety of verification methods to remain competitive and retain existing customers.

Read: Why the Focus on Self-Hosted Wallets?

What Is Fuzzy Name Matching?

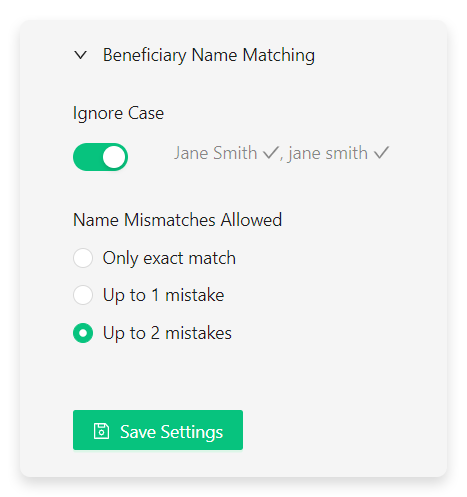

Fuzzy name matching allows for some “errors” in data. For example, the customer’s name is Jane Smith. If the VASP used exact name matching, only a customer with the exact name of Jane Smith would be accepted as accurate. However, with fuzzy name matching, a VASP can make room for case mismatches, space deletion and addition, and minor typos, for example, jane Smith, Jane smith and so forth.

What’s New in Version 6?

Below is a detailed breakdown of Version 6’s latest features.

In the toolbar, under configure VASP, VASPs can now select the level of severity with beneficiary names (fuzzy name matching).

This functionality benefits VASPs dealing with clients who use a different alphabet or have different language rules. It also helps better identify customers’ names received from their counterparty. With 21 Travel Rule, VASPs can choose how strict they would like their settings to be. Users can ignore cases or accept zero, 1 or 2 mistakes.

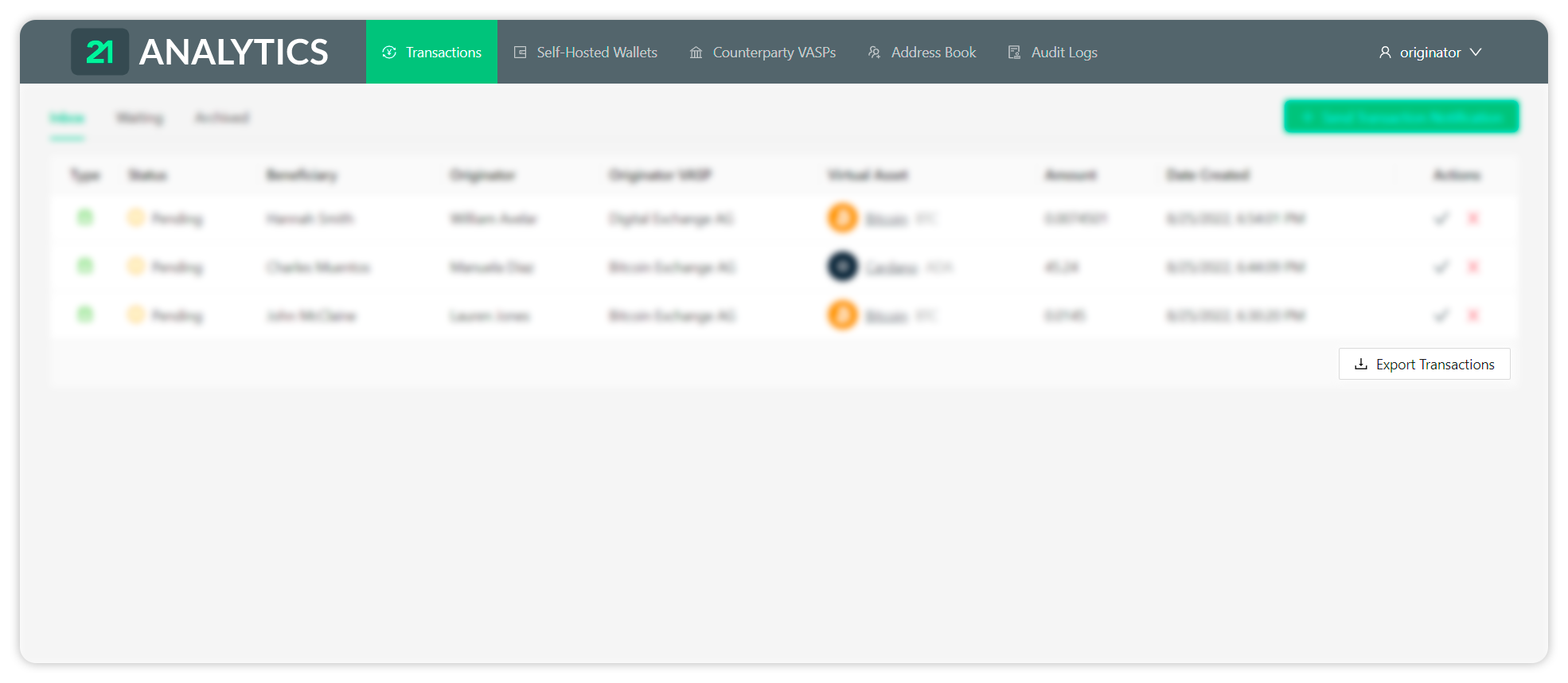

Unlimited file downloads.

The compliance team can export individual files per transaction under the Inbox, Waiting or Archived tab. Or export all executed transactions, which is excellent for audits as per Travel Rule regulations. For this option, users do not need to open all the transactions but merely click the Export Transactions button for a successful export. The downloads are automatically saved in an .xlsx (Excel) format to make things even more convenient for compliance officers.

Travel Rule Protocol (TRP) 3.0 is fully supported.

With TRP 3.0, all transactions between VASPs supporting TRP can be automatically approved with the auto-approve function. If activated, all transactions from a trusted VASP will move straight into the Waiting tab under Transactions. The result is time saved and less manual work for the compliance team.

Self-hosted Wallets: 4 verification methods are supported.

Under the Self-hosted Wallets tab, VASPs have 4 different self-hosted wallet verification methods available.

Due to the latest Regulations looking at self-hosted wallets more closely, VASPs have needed to up their self-hosted wallet verification offerings. By supporting 4 verification methods; AOPP, signature proofs, the Satoshi Test and visual proofs, VASPs can continue doing business unhindered and offer customers a verification option that suits their needs.

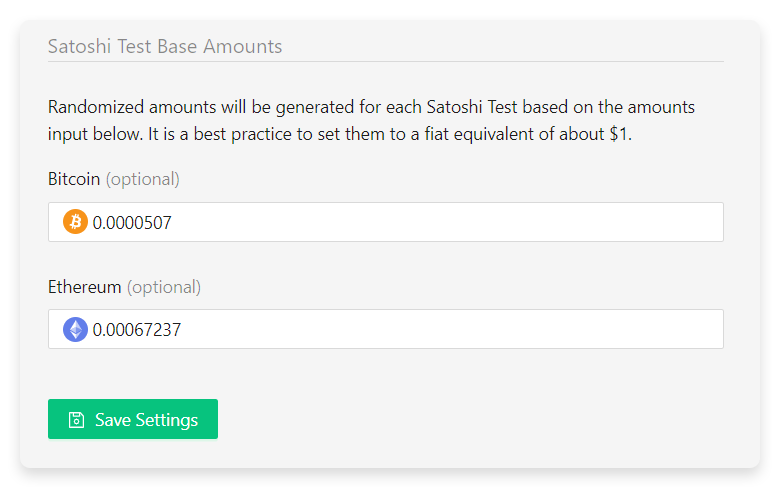

Satoshi Tests are one of the recent wallet verification methods added. While a fiat equivalent of USD 1 is recommended, VASPs can decide their values for Satoshi Tests.

Screenshots have evolved into Visual Proofs. The software now accepts videos and images as visual proofs with no format restrictions. Regarding size restrictions, that is up to the VASP to determine within a configuration file.

Other modifications include:

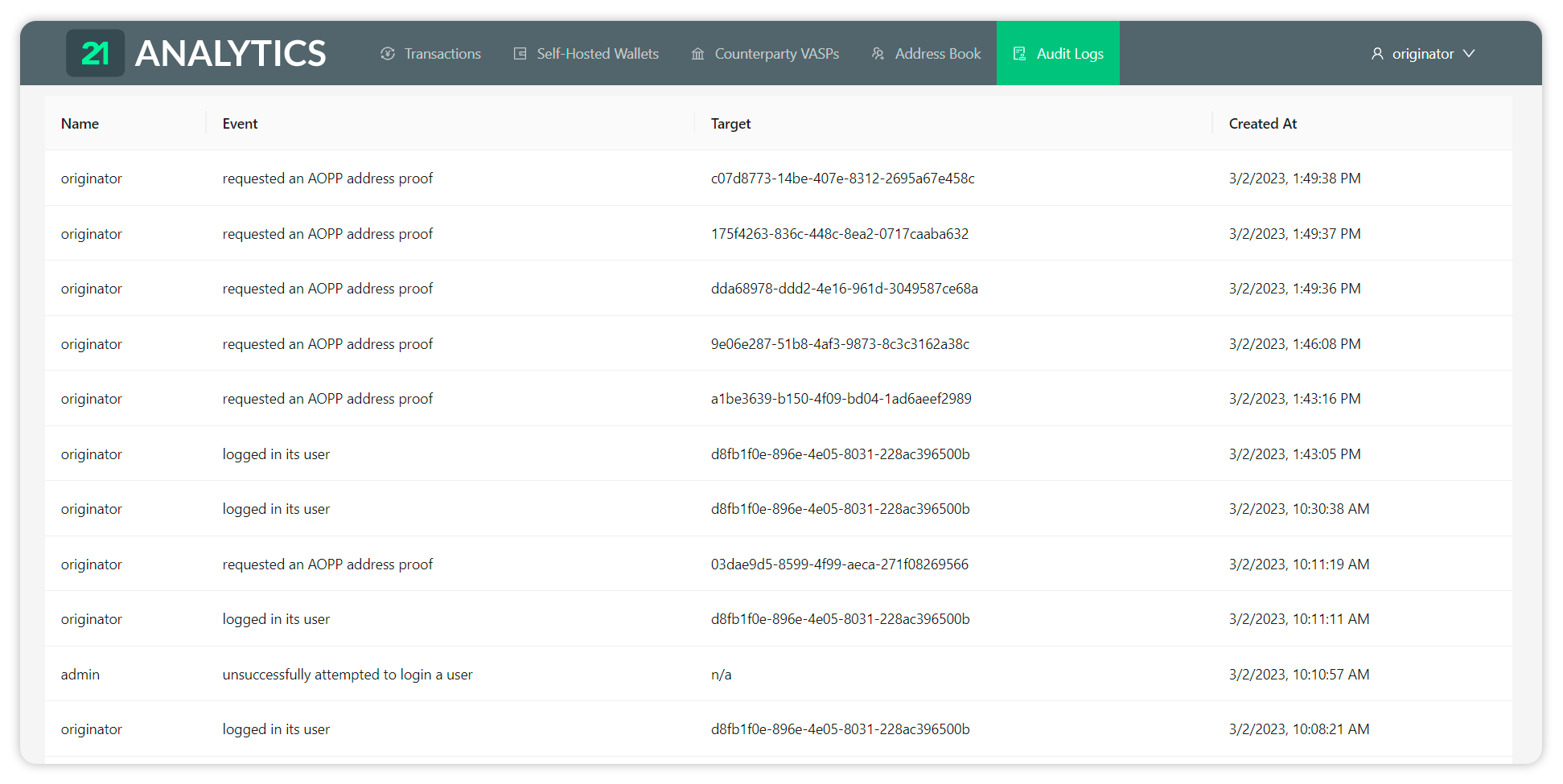

An Audit Log.

As actions are performed by the compliance team within the software, events are stored and logged into the Audit Logs tab. For each change, request, and transaction conducted, team members can look up the action history for an improved trail of which colleague performed which action at what point. These logs are tamper-proof and serve as a means for VASPs to ensure that AML/CTF standards are always upheld.

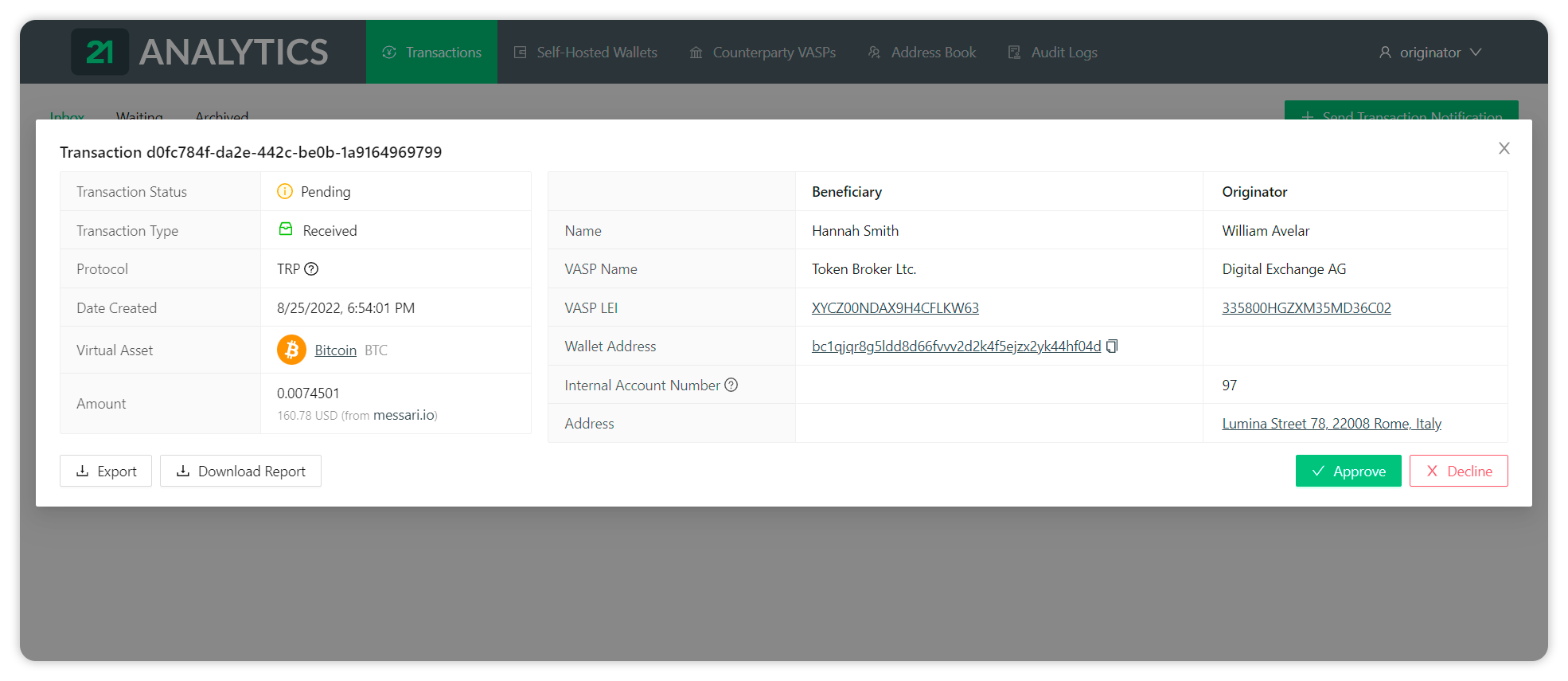

VASPs can now view customer transfer information in 1-click.

If a name is clicked on, a pop-out will appear, providing a neat overview with the option to Export or Download the report to desktop.

All Transaction tabs, Inbox, Waiting and Archived, support this functionality.

Throughout the software, the compliance team will notice:

clearer and crisper icons,

more functional buttons meaning less time aimlessly clicking around,

more explicit error messages, which means no time spent guessing what the actual error could be,

glowing buttons when icons are hovered on.

The result is a product that gives compliance officers even more time and control while offering an elegant user interface.

As with all our product updates, we have retained the essential features from previous versions, such as:

complete compliance with the FATF’s Travel Rule,

a streamlined user experience,

all VASP selected favourite features from Version 5.