Recommendation 15 Implementation Status by the FATF

This year, the FATF published the Status of Implementation of Recommendation 15 by FATF Members and Jurisdictions with Materially Important VASP Activity. The FATF, with the support of its Virtual Asset Contact Group (VACG), compiled the report to enable jurisdictions to implement the FATF’s Recommendation 15 (R.15).

"Our goal is to establish a level playing field, globally, so that the industry is meeting its regulatory obligations and reduce opportunities for criminals to abuse the sector."

T. Raja Kumar, FATF President.

Which Jurisdictions Have Implemented FATF's Recommendation 15?

The jurisdictions shown in these findings were chosen based on their trading volume and user base. The findings were obtained from the FATF’s 2023 survey of the global network (conducted from 24 February to 7 April 2023) with updates provided by jurisdictions from January to March 2024, mutual evaluation, follow-up assessment reports, and information from implicated jurisdictions. Thereafter, the findings were also supported by blockchain analytics.

Austria

Bahamas (R.15 rating: Compliant. 2022)

Belgium

Cayman Islands (R.15 rating: Largely Compliant. 2021)

Cyprus (R.15 rating: Largely Compliant. 2023)

Denmark (R.15 rating: Partially Compliant. 2021)

Estonia (R.15 rating: Partially Compliant. 2023)

France (R.15 rating: Largely Compliant. 2022)

Germany (R.15 rating: Largely Compliant. 2022)

Gibraltar (R.15 rating: Largely Compliant. 2021)

Hong Kong (R.15 rating: Partially Compliant. 2023)

India

Israel (R.15 rating: Largely Compliant. 2022)

Italy

Japan (R.15 rating: Largely Compliant. 2021)

Kazakhstan (R.15 rating: Partially Compliant. 2023)

Lithuania (R.15 rating: Partially Compliant. 2022)

Luxembourg (R.15 rating: Largely Compliant. 2023)

Malta (R.15 rating: Largely Compliant. 2021)

Mexico (R.15 rating: Largely Compliant. 2021)

Norway (R.15 rating: Largely Compliant. 2023)

Philippines (R.15 rating: Partially Compliant. 2020)

Poland (R.15 rating: Partially Compliant. 2021)

Republic of Korea

Singapore

Sweden (R.15 rating: Largely Compliant. 2020)

Switzerland (R.15 rating: Largely Compliant. 2020)

Thailand (R.15 rating: Largely Compliant. 2021)

UAE (R.15 rating: Partially Compliant. 2021)

UK (R.15 rating: Largely Compliant. 2022)

USA (R.15 rating: Largely Compliant. 2020)

Venezuela (R.15 rating: Partially Compliant. 2023)

The countries listed above have

conducted a risk assessment covering virtual assets and VASPs,

enacted legislation/ regulation requiring VASPs to be registered or licensed and apply AML/CFT measures,

registered or licensed VASP(s) in practice,

conducted a supervisory inspection or included VASPs in its current inspection plan,

taken enforcement action or other supervisory action against VASPs.

Where an R.15 rating has been issued, these jurisdictions have been assessed against the revised FATF Standards. Whereas, jurisdictions that have not been assessed against the latest FATF Standards do not carry a rating.

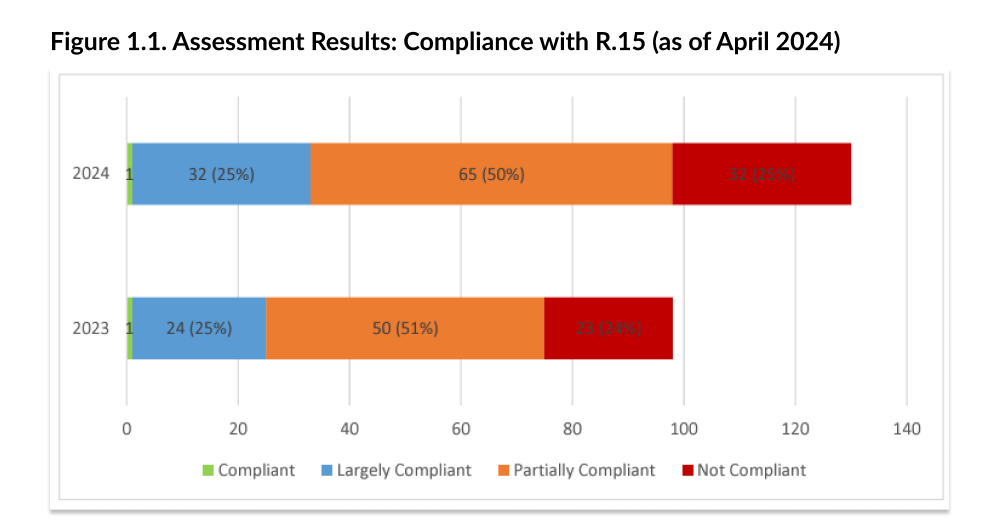

In its Targeted Update, the FATF stated that most jurisdictions (75%; 97 of 130 jurisdictions) are only partially (PC) or not compliant (NC) with the Recommendation 15 requirements. Only 32 jurisdictions (25%) are largely compliant, and one jurisdiction is fully compliant (the Bahamas).

Click here for the complete list of countries and their steps towards implementing R.15.

How Can VASPs Use These Findings to Their Advantage?

By using these findings along with the FATF’s Update Guidance on a Risk-based Approach for VASPs, VASPs can effectively gauge the level of risk posed by firms established in the listed jurisdictions, evaluate whether it is viable to transact with them, and, if choosing to transact with them, what risk strategy to implement.

Why Is the Implementation of Recommendation 15 Important?

As financial technologies evolve, new risks such as money laundering, terrorist financing, and other financial crimes emerge. R.15 ensures that financial institutions and regulators stay ahead of these risks by requiring them to assess and mitigate potential threats associated with new technologies. By implementing the appropriate safeguards, criminal exploitation of these systems can be mitigated.

R.15 promotes a consistent approach to managing technological risks across different jurisdictions, making sure jurisdictions recognise and deal with virtual assets in their regulations. This helps create a level playing field globally, ensuring that all financial institutions adhere to the same standards, which is crucial for international cooperation and global adoption of virtual assets.

The global implementation of Recommendation 15 is crucial because it holds countries accountable for risk mitigation, even if they choose to completely ban virtual asset activities locally. This approach is often seen as a simpler solution for regulators to manage the situation. Assessment results indicate that successfully prohibiting the use of virtual assets and VASPs is still challenging, and can effectively make jurisdictions non-compliant with FATF's Recommendations (Targeted Update 2024, item 10).

What Is the Relationship Between Recommendations 15 and 16?

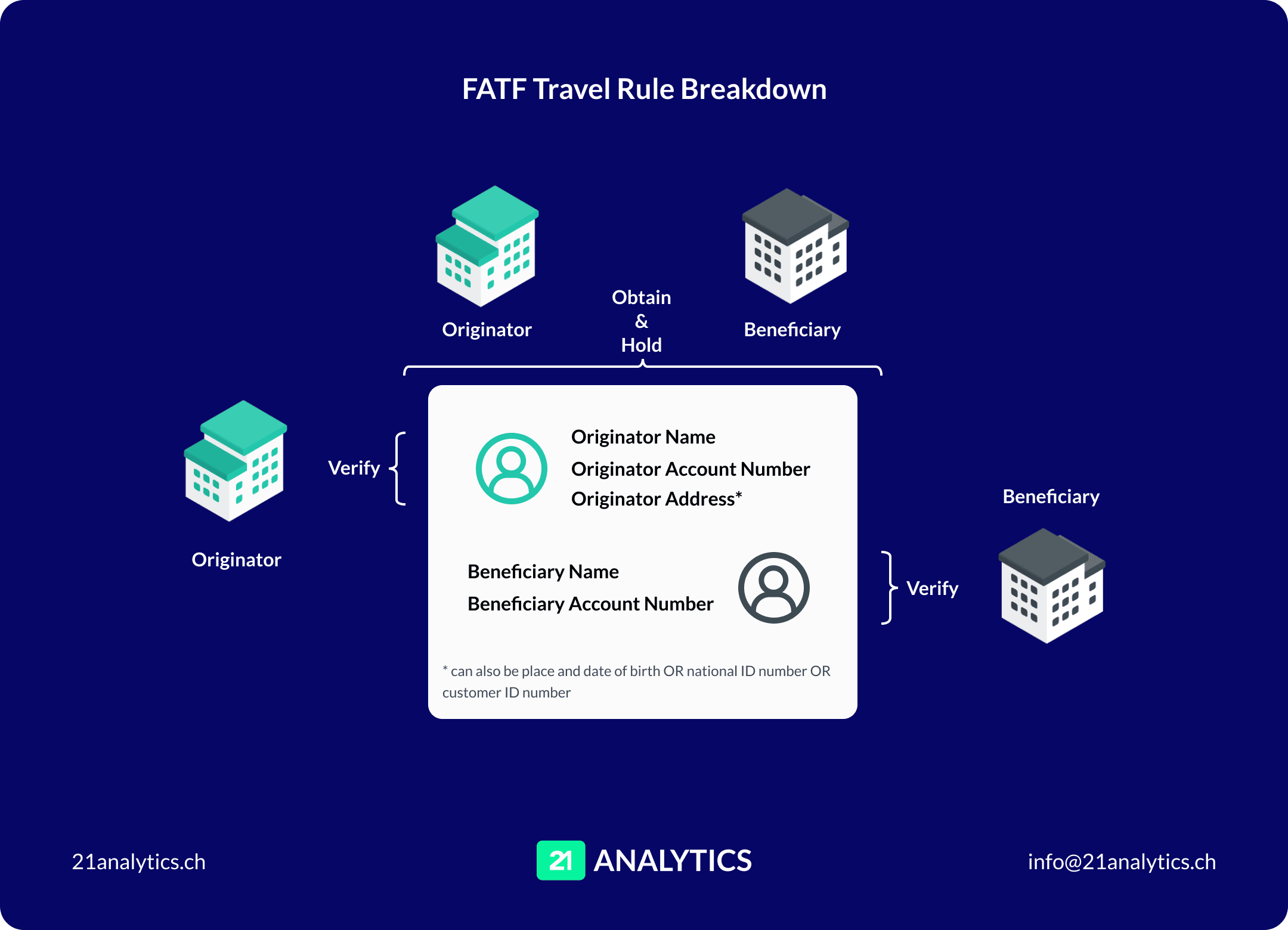

Updated in 2018 to include virtual assets and VASPs, Recommendation 16 (the Travel Rule) concerns the information that must accompany wire transfers.

The 2 recommendations work together. R.15 ensures that financial systems address the potential risks posed by technological advancements, such as virtual assets, by assessing and addressing risks before they occur.

Recommendation 16 aims to ensure that wire transfers are transparent and traceable by collecting and exchanging customer data for the involved parties. This, in turn, assists authorities in tracing funds if needed, reducing the risk of transacting with sanctioned parties or leveraging virtual assets for money laundering and terrorist financing.

To learn more about the FATF’s recommendations, specifically the Travel Rule, speak to one of our experts today.