IDAXA’s Peer-to-Peer (P2P) Recommendations

Established in June 2019, the International Digital Asset Exchange Association, more commonly known as IDAXA, has teamed up with various bodies in the cryptosphere to form a united voice. The goal of IDAXA is to enable growth within the industry while encouraging dialogue between the Blockchain and Crypto Trade Associations, members thereof, industry stakeholders, and regulators to find solutions for the Financial Action Task Force’s (FATF’s) Travel Rule compliance.

In the paper FATF Submissions 2022, IDAXA compiled the private sector's views on the Travel Rule, Peer-to-Peer (P2P) transactions, NFTs and Decentralised Finance (DeFi), as well as their recommendations to improve the regulatory landscape within these areas.

The objective of IDAXA’s P2P Recommendations was to identify where the main risks associated with P2P transactions lay and suggest solutions to mitigate these risks.

The FATF defines P2P Transactions As:

“VA transfers conducted without the use or involvement of a VASP or other obliged entity (e.g., VA transfers between two unhosted wallets whose users are acting on their own behalf). The FATF notes the inherent risks of such transfers resulting from the lack of a regulated third party involved and the global reach of these assets’ movement channels”.

IDAXA’s Peer-to-Peer (P2P) Recommendations

Comments and Findings

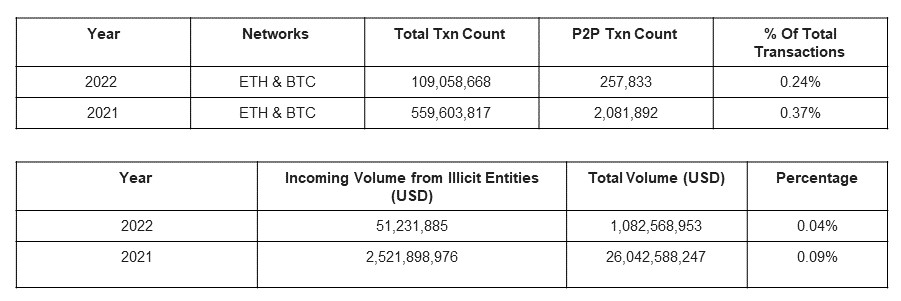

While IDAXA mostly agrees with and supports the FATF’s recommendations for P2P transactions, they believe that due to the low-risk profile of P2P transactions it should not be a priority for regulation. IDAXA’s opinion is supported by a four-year study conducted by Merkle Science. The study focused on the two main blockchains, Bitcoin and Ethereum and illustrated the low risk of P2P transactions. This study proved that P2P transactions play a minor role in virtual asset (VA) transactions. The majority of VAs transferred are done to and from a virtual asset service provider (VASP); therefore, the user was most likely KYC’d by the VASP.

The study can be summarised as

In 2022 P2P transactions constituted a mere 0.24% of transactions on these 2 networks (a decrease from 2021’s 0.37%)

Illicit activity linked to P2P transactions was 0.04%, again another drop from the previous year’s 0.9%

With these results in mind, IDAXA suggested the following:

Recommendations to the FATF

It would be more pertinent for FATF regulators to maintain a risk-based approach (RBA) and focus on the adoption and enforcement of the Travel Rule amongst VASPs and fight potential financial crimes associated with the increasing use of NFTs.

All VASPs should be regulated as per FATF standards.

The Travel Rule should be implemented as soon as possible. Through implementation, P2P transactions would not be an option for cybercriminals as it would be a closed ecosystem.

Further regulatory requirements applied to P2P transactions would only make it harder to trace illicit transactions as users would seek unregulated channels to transact through.

Appropriate controls need to be put in place, such as clear regulations and enforcement of these regulations. This includes CDD / EDD, ongoing transaction monitoring, and additional information to be requested for certain transactions.

For a detailed list of the points mentioned above, please refer to the IDAXA FATF Submissions 2022, pages 51-56. This joint effort helps bring the industry closer to regulators, which is crucial for a comprehensive yet practical regulatory landscape.