Global Implementation Status of the FATF’s Travel Rule

The enforcement of the Financial Action Task Force’s (FATF) Travel Rule globally emphasises the growing recognition of cryptocurrencies as a legitimate asset class and the need for consistent regulatory standards across borders. By complying with these regulations, businesses can build trust within the ecosystem, mitigate risks, and contribute to the crypto industry's long-term sustainability.

Below, we provide a breakdown of the countries that have implemented the FATF’s Travel Rule, or a variation thereof, which are in the process, the importance of regulatory frameworks, and whether virtual asset service providers (VASPs) can transact with jurisdictions that are not yet compliant with the Travel Rule.

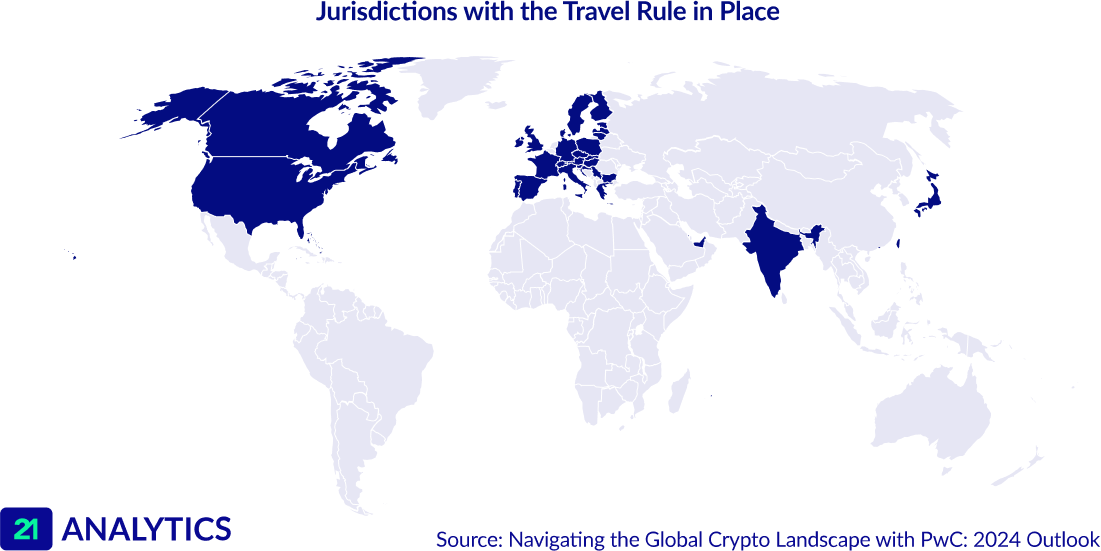

Countries with The FATF’s Travel Rule in Place

The following countries have implemented Travel Rule legislation or regulations, requiring VASPs in these jurisdictions to comply with its mandates during transactions.

Typically, the country with the stricter implementation of the Travel Rule dictates the level of information sharing required.

For example, the European Union (EU) has a more extensive set of data points to be exchanged compared to Singapore; therefore, when transacting, Singapore would need to meet the EU’s requirements. Additionally, thresholds of the transacting countries need to be observed to ensure Travel Rule compliance.

Austria

Bahamas

Bahrain

Belgium

Bulgaria

Croatia

Czech Republic

Denmark

Finland

France

Greece

Hungary

India

Ireland

Italy

Japan

Latvia

Lithuania

Luxembourg

Malta

Mauritius

The Netherlands

Poland

Portugal

Romania

Slovakia

Slovenia

Spain

Sweden

Taiwan

Türkiye

Countries That Have Initiated the FATF’s Travel Rule Process

Some countries are still shaping their crypto regulatory frameworks, anticipating the implementation of the Travel Rule soon. These countries include:

Australia

In February 2023, the Australian Government issued a consultation paper on 'token mapping,' initiating a multi-stage reform agenda to establish suitable crypto regulations. Draft legislation is anticipated in 2024, with a 12-month transition period before the law is enacted.

Brazil

As per Law 14,478/21, which emphasises anti-money laundering and counter-terrorism financing (AML/CFT), the Brazilian Central Bank is tasked with defining the conditions and timelines for crypto-asset service providers (crypto-asset brokers) to comply with the updated requirements. As specified in forthcoming regulations, these providers may offer virtual asset services solely or in conjunction with other activities.

Isle of Man

The Isle of Man Government is working alongside the Isle of Man Financial Services Authority and other government agencies to further develop the crypto regulatory framework and fintech industry.

Qatar

Qatar initially banned the use of crypto and virtual asset services, but it has since taken steps to develop a comprehensive regulatory framework. The regulation of virtual assets is progressing through phases. The initial phase is focused on drafting the legislation required to establish the Qatar Financial Centre (QFC) tokenisation framework.

Future phases will build on this foundation by developing a comprehensive regulatory framework tailored to specific virtual asset activities and products. Like Dubai in the UAE, Qatar has developed rule books to ensure the effective implementation of this framework.

The Importance of Regulatory Frameworks Like the Travel Rule

Some countries have yet to start formulating any crypto regulatory frameworks, let alone consider implementing the Travel Rule. The lack of regulatory frameworks brings a more significant issue: jurisdictional unequivalence.

Assuming the Travel Rule was standardised and implemented globally, VASPs would not face the "sunrise issue." A unified global framework would provide clarity on challenging aspects of the Travel Rule and simplify the regulatory environment for VASPs and their customers. For instance, while self-hosted wallets and VASP transactions are regulated under the EU’s TFR, they are not regulated in Canada, illustrating the inconsistency in regulations.

Additionally, the involvement of multiple local agencies, such as the six different ones overseeing crypto regulation in the US, leads to conflicting directives and fragmented systems. In some jurisdictions, restrictive or prohibitive crypto regulations can stifle market and technological growth, reducing investment, job, and educational opportunities. Furthermore, inconsistent global regulations create loopholes that cybercriminals can exploit and individual users can take advantage of, as seen in practices like structuring.

New Zealand, Turkey, and Uganda are some examples of countries that have yet to start formulating crypto regulatory frameworks.

Can VASPs Transact with Countries that Do Not Have the Travel Rule in Place?

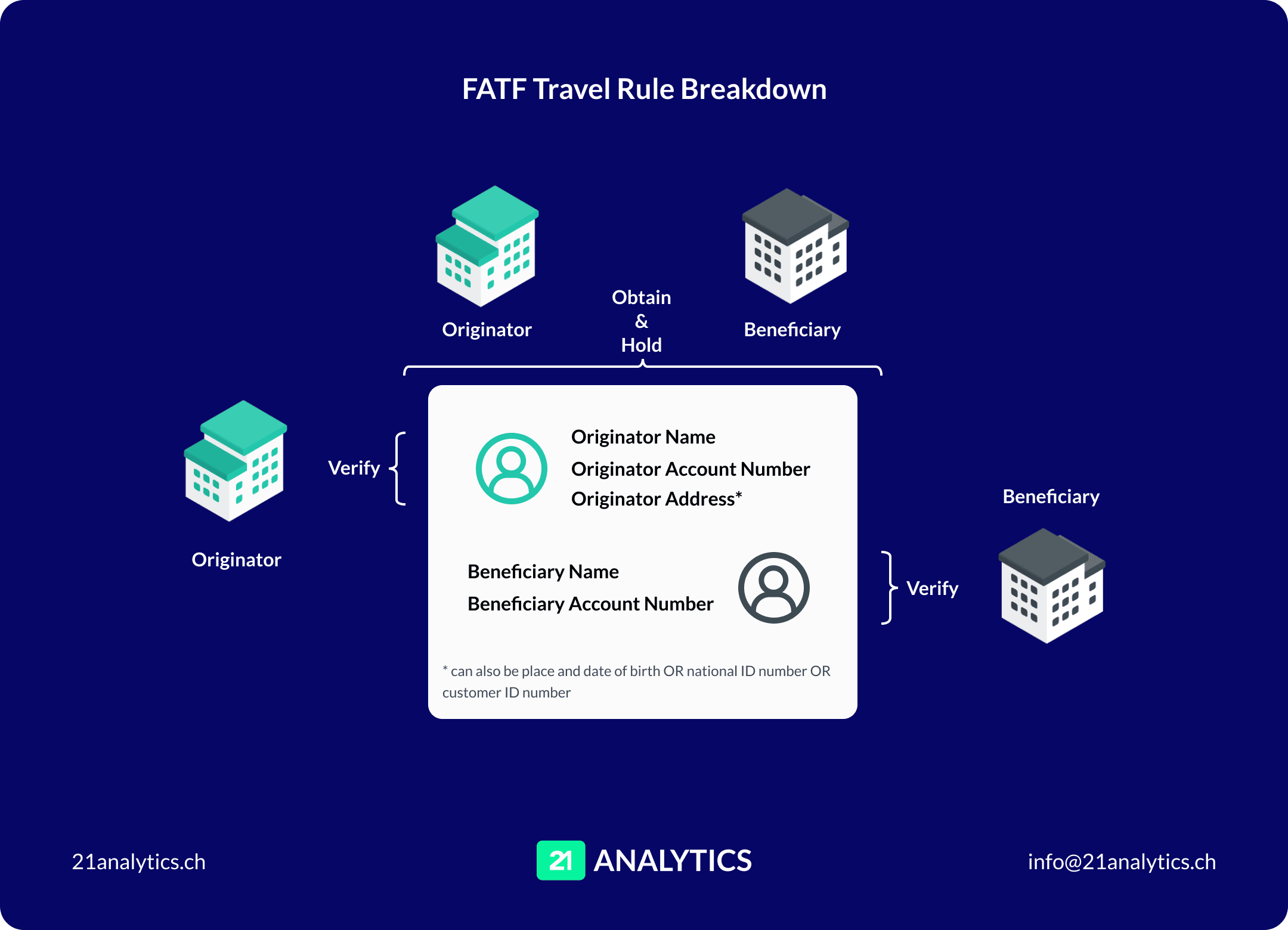

Yes, the sunrise issue does not stop jurisdictions with the Travel Rule in place from transacting with jurisdictions that don’t and vice versa, but this process is complex and often challenging. The Travel Rule requires two key actions during virtual asset transfers: collecting personal information about the parties involved and sharing this information between them.

These specific obligations vary depending on whether the VASP is sending or receiving the funds. For VASPs on the sending side, it is crucial to collect and transmit the necessary information to the recipient VASP. For those on the receiving side, the responsibility lies in receiving and storing the required data on the individuals involved.

However, VASPs must consider whether it is worth the risk to continue doing business with financial institutions that do not comply with the Travel Rule. Moreover, VASPs need a fallback solution to ensure they can send or receive data from their counterparty to meet their jurisdiction’s Travel Rule requirements.

Find out how to be Travel Rule compliant when your counterparties are not.

Additionally, explore 21 Sunrise, a solution designed to ensure uninterrupted transactions between VASPs in jurisdictions where the Travel Rule is not yet implemented.