Switzerland's Fourth Enhanced Follow-up Report by the FATF

The Mutual Evaluation Report (MER) for Switzerland was endorsed by the FATF Plenary in October 2016, leading to Switzerland being placed under enhanced follow-up due to identified compliance issues. Subsequently, in January 2020, Switzerland's third Enhanced Follow-up Report included technical compliance re-ratings. In this context, the fourth Enhanced Follow-up Report evaluates the nation's progress in rectifying technical compliance shortcomings pinpointed in the MER.

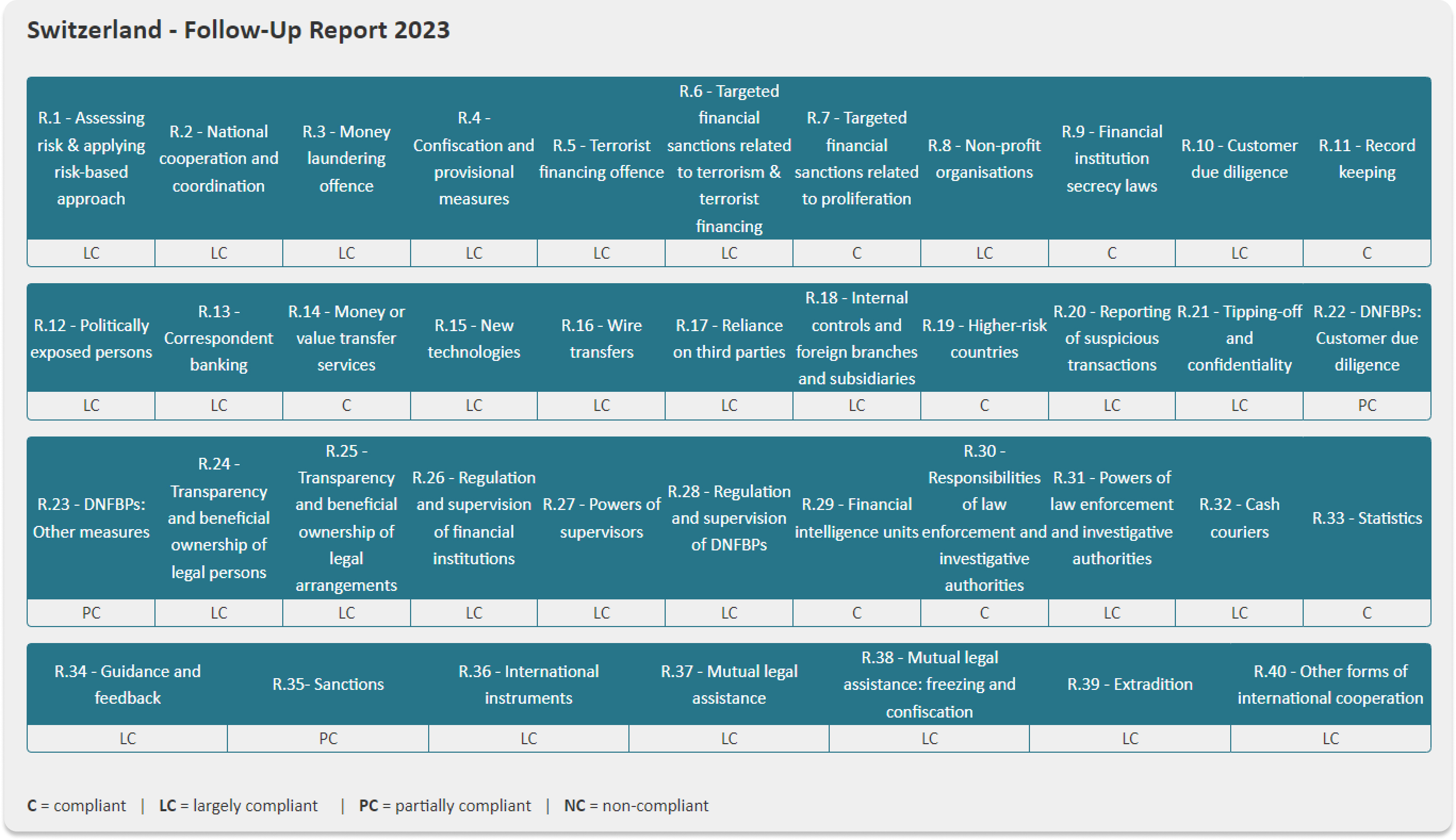

Where applicable, Switzerland was re-rated, reflecting the progress achieved. Below, Recommendations 10 and 40 (where Switzerland had fallen short), how the jurisdiction remedied their ratings, hurdles that still need to be addressed and what the future could entail are discussed.

What Is the Mutual Evaluation Report (MER)

A MER is a document produced to assess a country's compliance with international anti-money laundering (AML) and counter-terrorist financing (CTF) standards. International organisations, like the Financial Action Task Force (FATF), typically set these standards. Assessing this involves comprehensively reviewing a country's legal and regulatory framework.

Recommendation 10

| Year | Rating | |

|---|---|---|

| MER | 2016 | PC |

| 1st Follow-up Report | 2018 | PC (not re-assessed) |

| 2nd Follow-up Report | 2019 | PC (not re-assessed) |

| 3rd Follow-up Report | 2020 | PC |

| 4th Follow-up Report | 2023 | LC |

Source: FATF (2023), Anti-money laundering and counter-terrorist financing measures – Switzerland, 4th Enhanced Follow-up Report.

What is Recommendation 10?

Recommendation 10 pertains to customer due diligence.

The FATF 40 Recommendations state that financial institutions are required to retain essential transaction records, both domestic and international, for a minimum of five years. These records must be comprehensive enough to facilitate swift compliance with requests from competent authorities. They should enable the reconstruction of individual transactions, including details on currency amounts and types, when applicable, to provide evidence for potential criminal prosecutions.

Furthermore, financial institutions should retain records related to customer identification data, such as copies of official identification documents like passports, identity cards, and driving licenses, as well as account files and business correspondence, for at least five years after the termination of a business relationship. These identification data and transaction records should be accessible to domestic competent authorities upon receiving appropriate authorisation.

How Switzerland Reached a Largely Compliant Rating

Switzerland has undertaken measures to rectify the deficiencies highlighted in the MER and the previous follow-up assessment. A significant step in this process has been the revision of the LBA (Money Laundering Act), which has effectively addressed the issues related to verifying the beneficial owner's identity. Consequently, this has led to improvements in criteria 10.5, 10.8, 10.10, and 10.11, as well as the provisions concerning due diligence measures for existing customers and updating due diligence documentation and information

Gaps in Recommendation 10 Compliance To Be Addressed

The following gaps were noted but deemed minor. Hence, Switzerland received a Largely Compliant rating.

No specific text mandates banks to apply due diligence measures for occasional wire transfer transactions, even though such transactions are generally uncommon for occasional customers. Neither is there an explicit provision for verifying the beneficiary's identity in the context of life insurance and other investment-related insurance policies. Additionally, there is no clear requirement that financial intermediaries understand their clients' ownership and control structure.

Moreover, the need for an address is not explicitly outlined in documents similar to commercial register extracts, nor is there a clear provision where doubts arise about the beneficial owner's identity when the customer is a legal entity.

Lastly, the regulations do not explicitly mention the obligation to maintain ongoing due diligence beyond the mere execution of transactions.

Recommendation 40

| Year | Rating | |

|---|---|---|

| MER | 2016 | PC |

| 1st Follow-up Report | 2018 | PC (not re-assessed) |

| 2nd Follow-up Report | 2019 | PC (not re-assessed) |

| 3rd Follow-up Report | 2020 | PC (not re-assessed) |

| 4th Follow-up Report | 2023 | LC |

Source: FATF (2023), Anti-money laundering and counter-terrorist financing measures – Switzerland, 4th Enhanced Follow-up Report.

What is Recommendation 40?

Recommendation 40 refers to other forms of cooperation. Per the FATF 40 Recommendations, countries must facilitate seamless information exchange between competent authorities, spontaneously and upon request, related to money laundering and associated offences.

Cooperation should be unencumbered by restrictive conditions, with no refusal based solely on fiscal concerns.

Confidentiality laws at financial institutions should not impede cooperation.

Competent authorities can also conduct inquiries and investigations on behalf of foreign counterparts.

In cases where the counterpart lacks the mandate to obtain needed information, countries should encourage cooperation with non-counterparts. Collaboration with foreign authorities, whether direct or indirect, is essential, and when in doubt, competent authorities should consult their foreign counterparts. Countries should establish controls and safeguards for authorised information use to protect privacy and data.

How Switzerland Reached a Largely Compliant Rating

Switzerland has implemented several measures to enhance its technical compliance in international cooperation. These include:

The incorporation of a provision in the LBA that empowers MROS (Money Laundering Reporting Office Switzerland) to request and receive information from a financial intermediary in response to a foreign counterpart's request, even in cases where there is no connection with a Suspicious Transaction Report (STR) submitted to MROS by a Swiss financial intermediary.

A revision of the terms governing collaboration between the Federal Office of Justice (CFMJ) and its international counterparts.

The gaps mentioned below were considered minor, so the jurisdiction received a Largely Compliant rating.

Gaps in Recommendation 40 Compliance To Be Addressed

The "client procedure" of FINMA, which involves notifying the concerned party before sharing information with foreign authorities, has become less significant in practice, reducing potential delays in data transmission. However, it remains in effect.

The CFMJ has yet to engage in reciprocal requests with its foreign counterparts, leading to a lack of established practices for providing feedback.

Concerning the oversight of foreign groups with Swiss establishments, FINMA's measures to facilitate access to foreign authorities' files within the cooperation framework still have some limitations. These limitations include foreign authorities determining the selection criteria for files and files being randomly chosen based on anonymised client lists created by financial institutions or audit firms.

What Does This Mean Going Forward?

Switzerland is virtually compliant with the FATF’s Recommendations in all accounts, except for Recommendations 22, 23 and 35, where it received a Partially Compliant. Regarding these 3 recommendations, Switzerland will move into a monitoring phase and update the FATF on its progress during its next evaluation.

Being 100% compliant with all of the FATF’s Recommendations strengthens Switzerland’s financial institutions' standings globally, encouraging foreign investment and fostering economic stability. Furthermore, it promotes greater security by curbing the channels through which criminal activities are funded, thereby contributing to global efforts to combat transnational crime and terrorism. In essence, embracing the FATF's Recommendations is a win-win for both nations and the world, as it ensures the long-term stability and prosperity of the global financial landscape.

Read more on Switzerland's membership with the FATF.

Getting Involved In the Swiss Crypto Scene

We can support you through your cryptocurrency venture in Switzerland. Whether your objectives include establishing a VASP, securing regulatory licenses, providing training for your development team, or becoming compliant with the Travel Rule, we can assist you.

Leverage our extensive Swiss network and expertise - reach out to 21 Analytics directly to explore opportunities for you or your company to participate in Switzerland's blockchain landscape.

Reach out to our team or learn more about our consulting services today.