The Benefits of 21 Analytics’ LEI Generator

Product integration testing is essential for reaching interoperability. It is by conducting user acceptance tests and contributing to product development that we are able to build better solutions to facilitate compliance with the FATF's Travel Rule.

More specifically, several EU regulations—MiFID II and EMIR, for example—require that counterparty identification in financial transactions be done using LEI codes. What's more, these codes play a role in transaction reporting. Additionally, in line with the EU’s implementation of the Travel Rule, both the originator and beneficiary CASP are to provide LEI codes when conducting a crypto asset transfer.

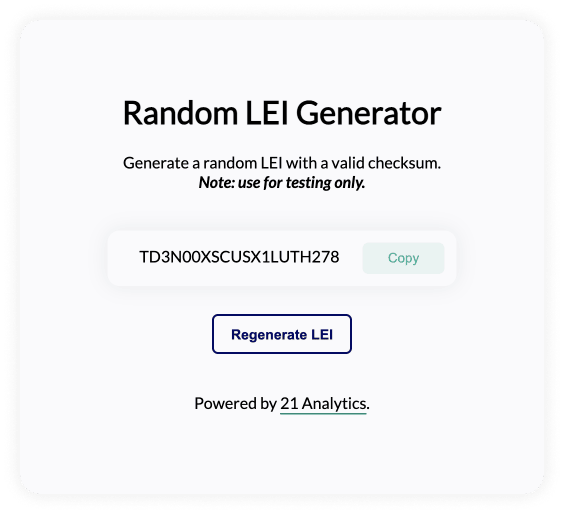

Due to checksum, it is virtually impossible for humans to come up with valid LEI codes. To remedy this, 21 Analytics have developed a generic LEI Code generator. This tool is free for anyone and everyone to use and is incredibly simple to navigate. With 1 click, you will have a LEI Code. The generic LEI Code can be used to test products and software. Additionally, it is a safe option if you do not want to use your existing LEI Code to test with.

What Is a LEI?

A Legal Entity Identifier (LEI) is a code that is unique to an entity. The code is a 20 alpha numeric combination and allows for companies to be identified on a global database. When using the Global Legal Entity Identifier Foundation’s (GLEIF’s) LEI search, the following data will be displayed;

the company’s name,

address,

if the company is an affiliate of another company and

where the company has been registered.

The codes are standardised globally which allows to globally and uniquely identify business entities.

Why Do We Have LEI Codes?

In the 1900s, global trade grew at an incredible rate. Along with the growth of trade came the need for transparency in transactions, especially with international trade. During this time, there was no unique method to identify entities which caused many problems. A company could be owned by a bigger company, which could be owned by another company.

The result was complete confusion as entities did not have a clear idea of who they were dealing with. Furthermore, it occasionally led to fraud and money laundering cases, precisely what the FATF is trying to put a stop to. In other words, LEI Codes are vital for transparency, especially in the international finance arena as financial institutions need to know who they are dealing with.

When finance went digital, the need for identifying entities resurfaced. The issue was resolved at the G20 Summit of June 2011. It was at this summit that the concept of LEI Codes was created.

The Benefits of a LEI Code

A LEI Code forms a source of trust between entities. The code can be typed into a LEI database to verify a company. Moreover, it allows for easier customer onboarding, anti-money laundering (AML), and improved Know-Your-Customer (KYC) practices. LEI Codes are reliable as they cannot be duplicated, unlike company names. Furthermore, they are beneficial for identifying an entity that does not have a strong digital presence. All LEI Codes are standardised and recognised as an official standard by the International Organisation for Standardisation (ISO Standards).

Do I Need a LEI?

If your entity is involved in any financial transactions or operates within the financial ecosystem, then you have probably registered at GLEIF already. It is important to remember that international directives mandate LEIs, and many jurisdictions simply will not operate with entities that do not have a LEI.

For further information be sure to check out the GLEIF’s LEI video.

Navigate our LEI generator today! Contact us for more information.