The FATF’s Crypto Travel Rule: Global Implementation Summary

For the latest list of jurisdictions where the Travel Rule is live refer to: Global Implementation Status of the FATF’s Travel Rule.

The Financial Action Task Force (FATF) started looking at virtual assets in 2014 and published a guidance focusing on regulated exchanges in 2015. By 2019 they had defined virtual assets and virtual asset service providers (VASPs) and declared that the Travel Rule would be applicable when transferring virtual assets.

Fast forward to 2023, and we have seen various jurisdictions implement or are in the process of implementing the FATF’s crypto Travel Rule. With this staggered implementation of the Travel Rule - also known as the sunrise issue - many VASPs are unsure where their counterparty stands.

With the FATF’s Crypto Travel Rule: Global Implementation Summary, VASPs can quickly glean where their counterparty is regarding the Travel Rule, which in turn aids VASPs in their transaction with the said counterparty. For example, do they transact according to the Travel Rule, or should a sunrise solution be applied?

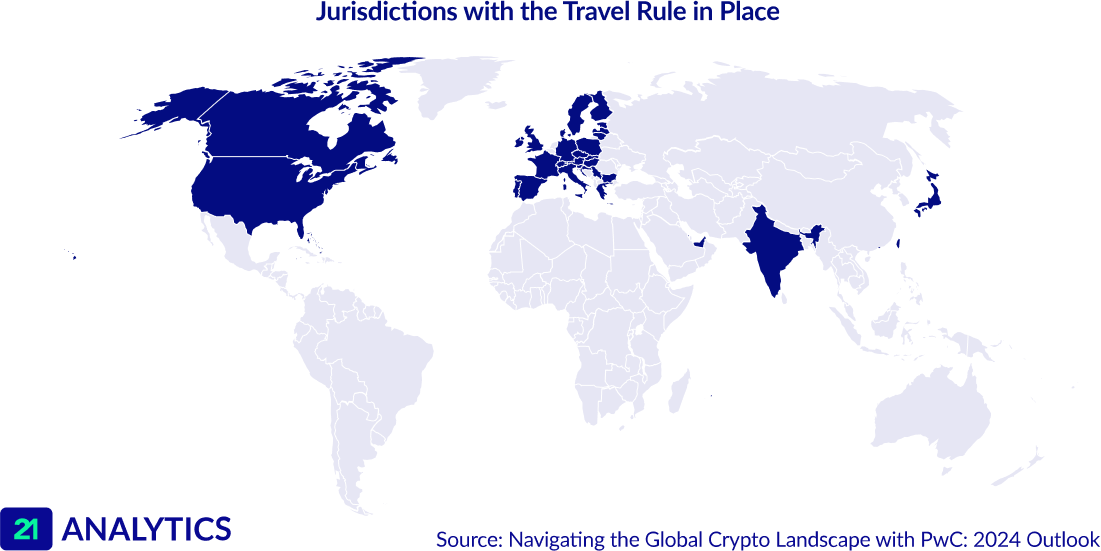

Countries with The FATF’s Travel Rule in Place

The following countries have Travel Rule legislation or regulations in place. When VASPs from these regions transact, they must do so according to the Travel Rule’s requirements.

The observed reality is that the VASP's country with the more limiting implementation of the Travel Rule will define which information should be shared. For instance, Switzerland has a zero threshold, whereas Canada has a threshold set at CAD 1000. Irrespective of which VASP is sending or receiving the funds, both will adhere to the requirements of the zero threshold, since the Swiss VASP will demand it.

Counties with the Travel Rule in place include:

Austria

Bahamas

Bahrain

Belgium

Bulgaria

Croatia

Czech Republic

Denmark

Finland

France

Greece

Hungary

India

Ireland

Italy

Japan

Latvia

Lithuania

Luxembourg

Malta

Mauritius

The Netherlands

Poland

Portugal

Romania

Slovakia

Slovenia

Spain

Sweden

Taiwan

Türkiye

This is a non-exhaustive list. Please be aware that while some countries have legislation or regulations governing the use of virtual assets, this is not equivalent to the Travel Rule. Simply put, the Travel Rule relates to the exchange of information during a virtual asset transfer between financial intermediaries, as per the FATF's Recommendation 16.

For more clarification on the Travel Rule, read: What Is the FATF Travel Rule?

Countries That Have Initiated the FATF’s Travel Rule Process

Many countries have initiated the Travel Rule process or have policies governing the use of virtual assets. The EU’s Transfer of Funds Regulation (TFR) is to be approved this week, meaning crypto asset service providers (CASPs) operating in the EU must adhere to the Travel Rule. Once voted on, CASPs will have 18 months to fully comply with the Travel Rule’s requirements.

The UK’s implementation of the Travel Rule is also on the way, with it coming into force by September this year. Additionally, Hong Kong and Japan have indicated that the Travel Rule is on the cards for 2023.

Australia and South Africa have communicated frameworks and plans with their relevant organisations and bodies. The following countries have initiated the Travel Rule process but will fall under the scope of the TFR:

Austria

Italy

Luxembourg

Although the Travel Rule regulatory process has not been initiated in New Zealand, Oman, Panama or Turkey, cryptocurrency is legal in these states. China, Qatar and Saudi Arabia, on the other hand, forbid the use of cryptocurrencies.

How Do VASPs Transact With Countries That Do Not Have the FATF’s Travel Rule in Place?

Often VASPs see the sunrise issue rearing its head and are faced with the dilemma of figuring out how to continue transacting with their counterparties and remain Travel Rule compliant.

If the Travel Rule is already in effect, VASPs must assess the potential risks involved and determine whether they can continue transacting with companies not complying with its requirements.

The Travel Rule mandates two actions to be performed when transferring virtual assets:

collecting personal information about the individuals involved in the transfer, and

sharing the information between the companies involved in the transaction.

The specific requirements for each step may vary depending on the VASP’s role in the transfer, i.e., sending or receiving the funds. VASPs are to adopt different approaches to ensure compliance.

If on the sending side, VASPs must ensure they have collected and transmitted the necessary information to the recipient VASP. When responsible for compliance on the beneficiary's side of the transaction, VASPs must receive and store the required data on the individuals involved.

However, this is not as straight cut as one would hope; find out how VASPs can continue transacting seamlessly in a previous article, How to Be Travel Rule Compliant When Your Counterparties Are Not. In the article,this topic is tackled in-depth and a solution is shown to VASPs facing the sunrise issue. Additionally, see 21 Sunrise. 21 Sunrise ensures uninterrupted transactions between VASPs in regions where the Travel Rule is not live.

Contact us to find out how to be compliant in every Travel Rule scenario.