In 2019, FinCEN issued guidance on convertible virtual currencies (digital assets), emphasising that the Travel Rule was in effect. With that, cryptocurrency could be legally bought and sold from another person, crypto exchanges, bitcoin ATMs, and some banks throughout the United States. Major US-based exchanges and financial institutions — such as Coinbase, Kraken, Gemini, and Fidelity — have since strengthened their compliance efforts by joining the TRUST network, which facilitates secure and standardised Travel Rule data exchange.

The Bank Secrecy Act (BSA), overseen by FinCEN, is the primary regulation for all AML/ CFT activities within the USA.

Under the Biden Administration, the US focused on implementing further crypto regulations within the ecosystem. Additionally, the US Securities and Exchange Commission (SEC) paid greater attention to regulating crypto markets. In fact, the Financial Innovation and Technology for the 21st Century Act (FIT21) was passed in May 2024.

The act classifies digital assets based on the decentralisation of their underlying blockchains, providing much-needed clarity for the industry

With the Trump Administration, the country has adopted a proactive stance towards the cryptocurrency sector, implementing policies aimed at fostering innovation and solidifying the nation's leadership in digital finance.

In January 2025, President Trump issued an Executive Order to establish regulatory clarity for digital financial technology. This order created the Presidential Working Group on Digital Asset Markets, tasked with developing a comprehensive federal regulatory framework for digital assets, including stablecoins. The order also prohibited federal agencies from issuing or promoting CBDCs, emphasising a preference for decentralised digital assets and private-sector innovation.

In March 2025, we saw further movement when the President signed an Executive Order to establish a Strategic Bitcoin Reserve and a US Digital Asset Stockpile.

The Strategic Bitcoin Reserve is designed to centralise and manage bitcoin assets seized through forfeiture, treating them as strategic reserves. The US Digital Asset Stockpile encompasses other digital assets obtained similarly. This is another initiative aimed at positioning the United States as a leader in digital assets.

What is the scope of the Travel Rule in the US?

Per the guidance issued in 2019, the US Travel Rule is applicable to all business models involving convertible virtual currencies (CVCs) and Money Services Businesses (VASPs). This includes:

Peer-to-peer exchanges,

CVC wallet providers,

CVC kiosk operators,

CVC payment processors,

Decentralised apps (DApps)*

Trading platforms

ICOs

* If a DApp receives and sends value, FinCEN may classify its owners or operators as money transmitters. In contrast, developers who only create software that enables network or communication services may fall outside this classification.

Who are the supervisory bodies for VASPs in the US?

FinCEN plays an essential role in regulating cryptocurrencies within the USA. However, various US agencies regulate different cryptocurrency activities.

Financial Crimes Enforcement Network (FinCEN) is responsible for the regulation of digital assets for AML/CFT purposes.

US Securities and Exchange Commission (SEC) oversees regulated digital asset-considered securities by applying the Howey Test.

Commodity Futures Trading Commission (CFTC) regulates CVCs, which are considered commodities (for example BTC + ETH).

Office of the Comptroller of the Currency (OCC) is responsible for banks participating in the ecosystem.

Internal Revenue Service (IRS) is responsible for tax collection.

Federal Bureau of Investigation (FBI) is responsible for crime enforcement at a federal level.

Office of Foreign Assets Control (OFAC) is responsible for overseeing compliance of the US cryptocurrency regulation involving sanctions.

What is the Travel Rule threshold in the US (FinCEN)?

USD 3000.

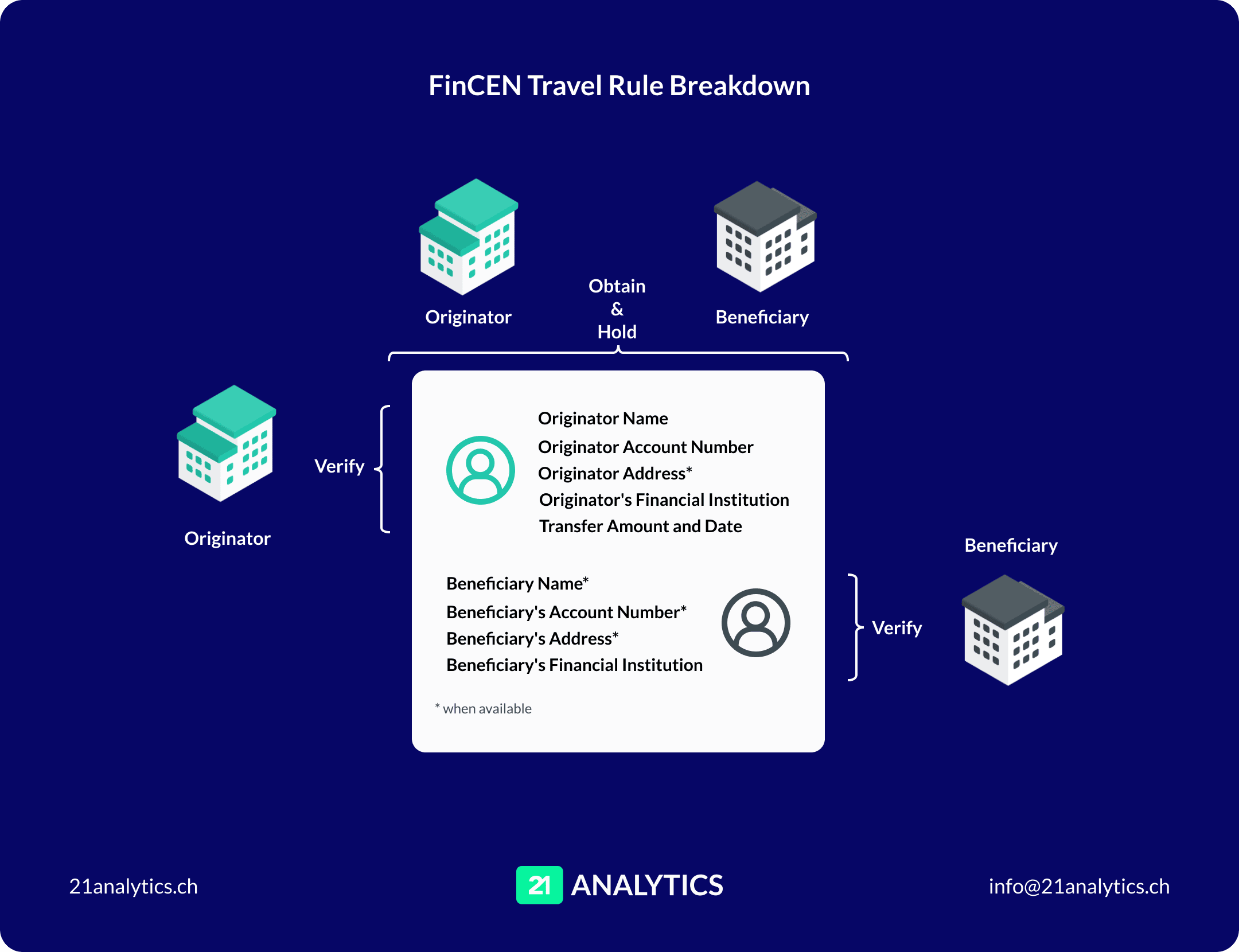

What are FinCEN's requirements for Travel Rule information to be exchanged?

For transactions equal to or above USD 3000, the following data must be collected before or at the time of the transaction:

originator’s name;

originator's account number (when available);

originator's address;

originator's financial institution;

transfer amount and date;

beneficiary’s name (when available);

beneficiary’s account number (when available);

beneficiary's address (when available);

beneficiary's financial institution.

In all instances, Money Services Businesses (MSB) are to keep copies of customer payments and transfers, even in transfers under USD 3000. The regulation does not confirm how the information is to be collected, verified, or transferred.

Does the US Travel Rule apply to self-hosted wallets?

Unhosted wallets (self-hosted wallets) are subject to the Travel Rule.

When a transaction occurs between an unhosted wallet and an MSB, the wallet owner is only covered by the Travel Rule if the transaction meets the definition of a “transmittal of funds”.

If it qualifies as a transmittal of funds, the MSB must comply with the Travel Rule according to its role in the transaction chain, whether as the transmittor, intermediary, or recipient financial institution.

The Travel Rule does not apply when unhosted wallets are used solely for personal transactions.

Become Travel Rule Compliant with 21 Analytics

When do you need to comply with the Travel Rule in the US?

Now.

Which regulations are applicable to the US Travel Rule?

Department of the Treasury Semiannual Agenda

What else do you need to know about the Travel Rule in the US?

While the FATF uses the terms virtual asset and virtual asset service provider, FinCEN uses the terms convertible virtual currency (CVC) and Money Services Business (MSB).

A “transmittal of funds” is defined as a series of transactions beginning with the transmittor's transmittal order, made for the purpose of making payment to the recipient of the order (CFR § 1010.100(ddd)). The term includes any transmittal order issued by the transmittor's financial institution or an intermediary financial institution intended to carry out the transmittor's transmittal order.

The term transmittal of funds includes a funds transfer. A “funds transfer” is a series of transactions beginning with the originator’s payment order, made for the purpose of making payment to the beneficiary of the order. The term includes any payment order issued by the originator’s bank or an intermediary bank intended to carry out the originator’s payment order (CFR § 1010.100(ddd)).

Cryptocurrency exchanges that do not register as an MSB will be in breach of the Bank Secrecy Act and AML/CFT regulations.

Crypto fund managers who invest in crypto futures must be licensed by the Commodity Futures Trading Commission (CFTC) as Commodity Trading Advisors and Commodity Pool Operators.

Cryptocurrency is taxed under capital gains or losses (if the CVCs are held for less than a year, short-term capital gains are applied, and the opposite for long-term investments). Moreover, cryptocurrency is classed as property.

US taxpayers must retain detailed records for crypto transactions and report them to the IRS.

The IRS taxes cryptocurrency mining and payment for services/goods with cryptocurrency as income.